Advantages of Cashing In Your Merchant Services Residual Portfolio

Unlock the potential of your merchant services residual portfolio by cashing in at the right time.

Freeing Up Resources for New Opportunities

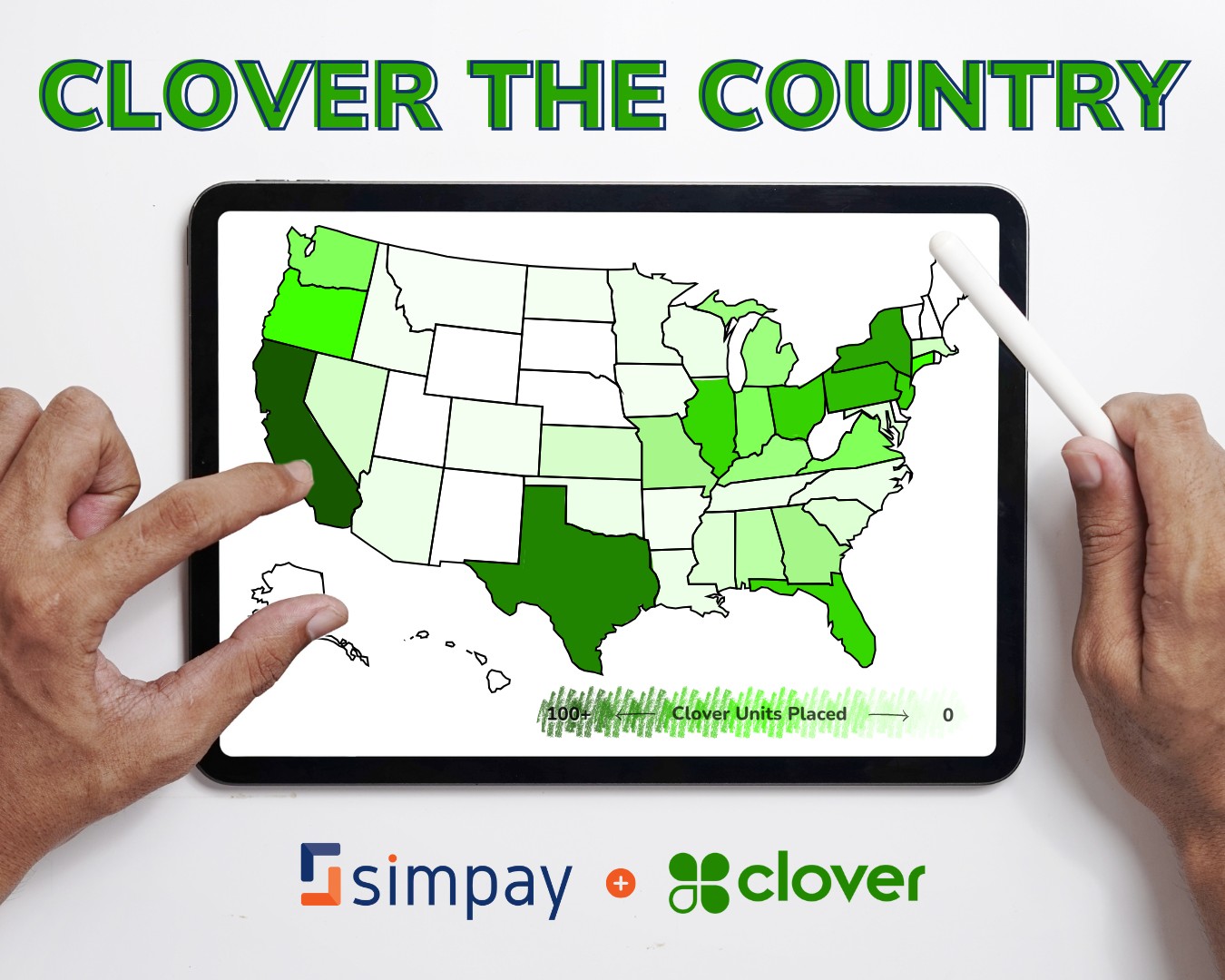

Simpay is actively working with ISOs and Agents, purchasing books of business. If your residual book is with Simpay, we can fund your offer within a few days. If your residuals are elsewhere, and you have the portability to sell them, we'll do an evaluation. Extremely well positioned books may see as much as a 30X buyout.

There Might be Signs

You don't have to tell anyone you're cashing out your residual book, but we're guessing there might be signs. Your social media feed might be suddenly filled with pictures of exotic vacations, new cars, or your new house.

Cashing in your merchant services residual portfolio can provide the liquidity needed to explore new business ventures or investment opportunities. Whether you're looking to start a new business, expand an existing one, or invest in different assets, having access to a lump sum of cash can be a game-changer.

The freed-up resources can be used to pay down debt, fund personal projects, or even as a financial cushion. By reallocating your financial resources, you can potentially achieve higher returns or fulfill other personal and professional goals.

Maximizing Financial Gains through Portfolio Liquidation

Selling your merchant services residual portfolio can offer a substantial financial windfall, especially if the portfolio has been performing well. By liquidating all or part of your residual income, you can convert future residual streams into a significant lump sum of cash. This is particularly advantageous if you have immediate financial needs or investment opportunities requiring a larger capital outlay.

Moreover, market conditions and buyer demand will drive up the value of your portfolio, providing an optimal window for selling. Evaluating your portfolio's current worth and comparing it to potential future earnings can help you make an informed decision about when to sell for maximum profit.

Let's set up a call to talk about your portfolio. Contact Josh Elsass directly or give us a little info below and we'll reach out to you.